Please note!

Ecopayz has now changed it’s name and is now referred to as Payz. So, if you are searching for this method or planning to use this, it can be found referred to as Payz.

If you frequently play at online casinos, you’ve likely noticed that Payz is a popular payment option across a wide number of sites. Below, we’ve covered everything there is to know about Payz, including how to deposit, withdraw, sign up, and much more!

Table of contents

Best Payz Online Casinos in India 2025

5,000+ games

User-friendly interface

Hindi language available

Reputable game developers

Has an intuitive mobile app

Generous bonuses

Has a VIP club

Top promotions

Has a live casino cashback

Sportsbook available

Regulated by iTech labs

3,000+ games

Several secure payment options

Top offers

What Is Payz?

Shortlisted among the Best Payment Solutions of the Year in the 2018 Global Gaming Awards, Payz is an online payments service that allows customers to make transactions online. The platform is owned by PSI-Pay Ltd., a reputable electronic money company with roots in the UK. Even though Payz started in 2008, it reached its pinnacle when the company partnered with Mastercard and released its first-ever mobile app.

Since then, it has grown in popularity worldwide, and has been accepted even in India. As if all of the new features and upgrades weren’t enough, Payz now works with Western Union and is available in various options, including ecoAccounts, ecoCards, and ecoVouchers, so you can use whichever option that suits you best!

Why Is Payz Popular in India?

Payz processes a high number of online transactions in India, even surpassing several local payment options. Not only is it one of the fastest and most secure online payment services out there, but its platform is also available in Hindi.

How To Sign Up for an Payz Account

Signing up for a Payz India account is easy, especially if you’ve already used a similar service online in the past. Follow the steps below to get started!

1. Download the Payz App

While you can make payments using the official desktop site, we think the app is much more convenient. You can download the latter from the site itself, or from Google Pay or the App Store.

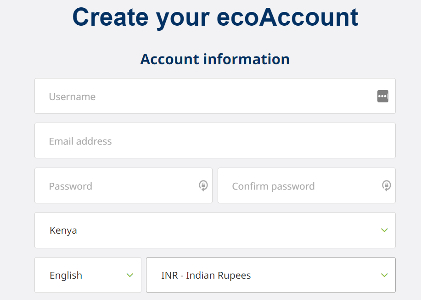

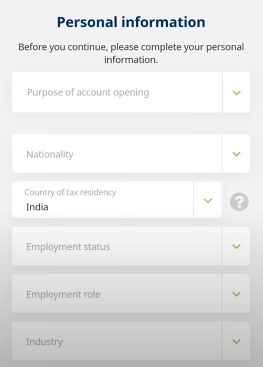

2. Fill in the Online Registration Form

After you’ve downloaded the app, tap on on the sign-up option.

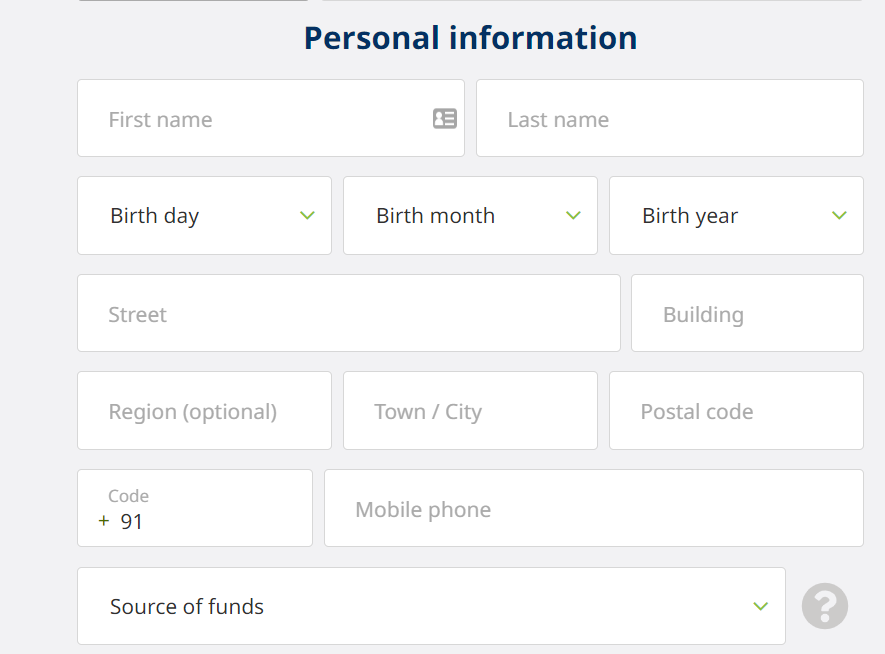

You’ll now be directed to a registration page where you need to enter your email address, residential address, phone number, and other details. Be sure to enter all this information accurately and correctly to avoid any hassles later on.

3. Activate Your ecoAccount

After you’re done, enter the CAPTCHA code, accept the terms and conditions, and finalise the process by clicking on ‘Create Account’.

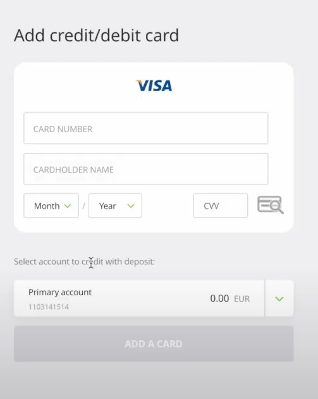

4. Link Your Debit/ Credit Cards or Bank Account

Before you can start using Payz, you’ll need to connect your account to a bank or credit/debit card. Select ‘ADD’ on the payment settings page, and enter the beneficiary’s name, account number, currency, bank name, physical address, and SWIFT code.

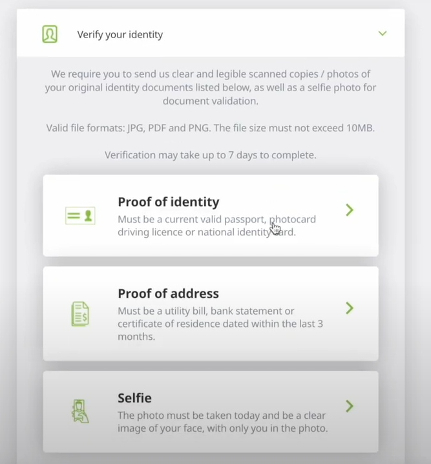

5. Verify Your Payz Account

Sign in to your account and select ‘Upgrade for free,’ followed by ‘Verify your identity.’ To verify your account, you’ll need to upload some identity documents like your driving licence, Aadhaar card, or passport. A recent bank statement and utility bill are also necessary for address verification.

6. Success!

Once you’ve set up your Payz account and logged in to your favourite Indian online casino, you can start using the service to make speedy deposits and withdrawals.

How To Use the Payz App

The most recent version of the app was launched in 2020, releasing even better and improved features in the process.

Here’s how you get started with the app after you’ve installed it.

Choose ‘Deposit Funds’

After you’ve opened the app, tap on the ‘Deposit Funds’ option to top up your account.

Select which account you want to top up

Payz allows its customers to have several accounts, so if you’ve got more than one, be sure to select which account you want to use.

Make your transaction

If you’ve linked your Payz account to any bank or credit/debit card, you’ll need to request for funds from these accounts. If you haven’t linked an account yet, you can do so in this step.

Confirm the payment

You’ll be required to confirm the transaction, after which your account will have an active balance.

Is Payz Safe To Use?

As a payment method that has processed millions of transactions, Payz has gone above and beyond to ensure tight security measures on its platform. For starters, the payment method uses SSL security encryption to ensure unauthorised third parties can’t access your info. It is also regulated by the Financial Conduct Authority (FCA) in the UK, a highly renowned and independent body within the country,

Furthermore, the platform has high Payment Industry and Data Security Standards (PCI and DSS) to protect customers from fraud or theft.

Deposit and Withdraw Using Payz

Unlike other casino payment methods, Payz can be used for both deposits and withdrawals, making it a highly convenient option. Here’s how you go about making both of these transactions.

How to Deposit at Payz Online Casinos

Sign up or log in to your chosen casino, and follow the below steps to make a deposit.

- Make sure that your ecoAccount is active and has been topped up with sufficient funds.

- Head over to the cashier section of the casino and pick Payz as your deposit method.

- You’ll be prompted to sign in to your Payz account and enter the amount of funds you wish to transfer.

- Once you’re done, insert your PIN and confirm the transaction.

- Wait for the cash to appear in your casino account.

- All done – you can now start playing!

How To Withdraw From Payz Casinos

After you’ve had your fun and managed to land some wins, you can cash out through these simple steps:

- Log in to your casino.

- Click on the ‘Cashier’ or ‘Withdraw’ section.

- Pick Payz as your withdrawal method.

- Verify your details and the amount you’d like to withdraw.

- Confirm the transaction and you’ll receive your funds within 24 hours or 2 days maximum.

Factors To Consider When Making Payz Payments

To make your transactions easier, there are a few things you need to keep in mind. Even though they might vary from casino to casino, they more or less apply no matter which site you are using.

Transaction limits: These usually vary from one casino to another, but more often than not, the minimum amount you can deposit and withdraw is ₹200. Different casinos usually allow different maximum withdrawal limits, so it’s best to check with the site that you’re registered with.

Transaction Fees: One thing we like is that there are no fees on any transactions, whether you deposit or withdraw. However, depending on the amount, your casino may charge you for processing payments.

Processing Time: Depositing is instant, with your funds usually appearing instantly in your casino account. On the other hand, withdrawals are usually processed within 24 hours or a few days at most.

Account activation and verification: To avoid any hitches later on, verify your account straight away by uploading your identification documents. Once the casino verifies your account, you can proceed to making transactions without any issues.

Pros and Cons

See our below table to view the positives and negatives of using Payz.

| Pros ✅ |

|

| Cons ❌ |

|

Alternatives To Payz

Looking for other similar payment options? We recommend e-wallets such as Skrill, NETELLER, PayPal, and Trustly, which also offer top security and convenience.

Other suggestions include:

- Cards: RuPay, Mastercard, and Visa

- Mobile: PhonePe, Google Pay, and Apple Pay

Conclusion

Payz is a speedy and secure payment option you can use it for both deposits and withdrawals. So, next time you fancy a round of blackjack or a few spins on your favourite slot, choose a Payz online casino from our list above and try it out for yourself!

FAQs

1. Is the Payz mobile app safe to use in India?

Absolutely! Payz is authorised and regulated by the UK-based Financial Conduct Authority (FCA), and uses SSL encryption as well as PCI and DSS security measures to protect customers.

2. How do I delete my Payz account?

To delete your account, you need to give a one-month prior notice and notify customer support of your decision.

3. What currencies can I use on Payz?

Payz accepts Indian rupees, USD, EUR, GBP, and several other currencies.

4. How do I deposit with Payz at a casino?

To top up your casino account, log into the casino, go to the cashier section, and choose Payz. Enter your preferred amount, provide the required credentials, and you’ll be good to go!